Government misled LegCo over COVID-19 broker handout

1 May 2020

The HKSAR Government (HSKARG) has misled LegCo with false and misleading statements to justify a handout to stockbroking firms as part of its bumper HK$137.5bn "Anti-Epidemic Fund" announced on 8-Apr-2020. That package had something for each of the rotten-borough "Functional Constituencies". There is an election coming up, you see.

Background

The so-called "Financial Services" seat in the Legislative Council (LegCo) is, in reality, the small-brokers' seat. The eligible electorate comprises each firm which is a participant in The Stock Exchange of Hong Kong Ltd (SEHK), Hong Kong Futures Exchange Ltd (HKFE) or The Chinese Gold and Silver Exchange Society. Each firm has 1 vote, regardless of size. Apart from electing the legislator, they also elect 18 members of the 1200-member Chief Executive Election Committee (EC, see our article Getting to 601, 28-Jan-2020). In the 2016 EC election, 622 firms were registered to vote.

Following demutualisation in 1999, both SEHK and HKFE are wholly-owned subsidiaries of Hong Kong Exchanges and Clearing Ltd (HKEX, 0388). Prior to that, they were owned by their trading members, with each of 929 SEHK shares providing one seat on the trading floor (some firms held more than 1 share, of course). There were only 230 shares in HKFE. The governing Council of SEHK had 31 members, of which 18 were divided into 3 quotas based on the ranking of firms by market share. The top 14 firms elected 4 seats for Category A, the next 51 firms elected 5 seats for Category B, and the remainder elected 9 seats for Category C.

Although the Council was abolished when HKEX was formed, the combined market shares of the 3 broker categories are still published monthly. Currently, categories A, B and C have market shares of about 60%, 33% and 7%, but of course, Category A only has 14 votes in the "Financial Services" elections. So it is Category B and C firms who decide the outcome of the LegCo seat and EC seats election. Asset managers have no votes.

The handout

The Government submitted a 141 page paper to the LegCo Finance Committee meeting on 17-Apr-2020. It told them in enclosure D15 (p69):

Accordingly, they proposed to give HK$50,000 to each Category B and C firm (790 firms, implying 51 in Category B and 739 in Category C). They've also introduced de facto negative licensing fees at the SFC, with each SFC-licensed individual receiving HK$2k on top of an earlier waiver of licence fees, although those fees are normally paid by their employers.

Turnover increases during volatility

First, market volatility (a measure of the movement in prices) is a product of uncertainty, which tends to increase turnover, not reduce it, for the simple reason that when the value of a stock is less certain, there will be more participants who think it is either overvalued or undervalued and therefore willing to sell or buy it.

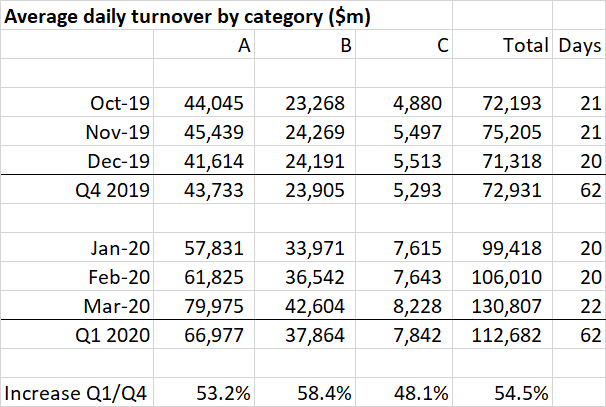

Here is our analysis of the turnover by Category, straight from HKEX data:

As you can see, average daily market turnover has jumped 54.5% in the first quarter of 2020 to HK$112.7bn versus $72.9bn in the last quarter of 2019. Category B and C brokers have seen a 58.4% and 48.1% jump respectively. They haven't been "particularly hard-hit" as the FSTB claims. Their revenues have shot up correspondingly, and their profits too. Their income has not been "adversely affected" as the HKSARG claims.

Retail investors

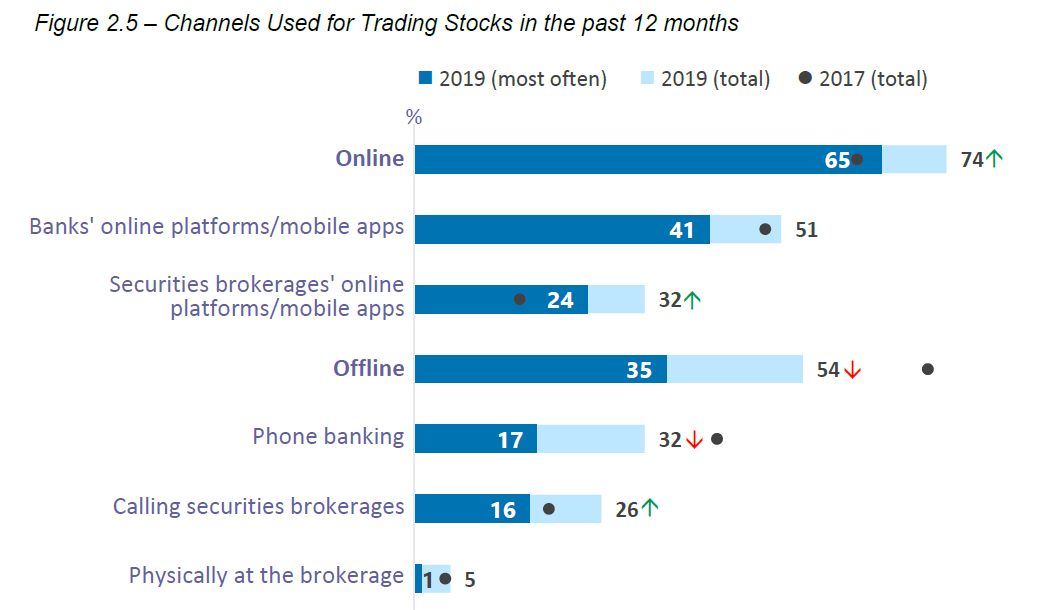

Second, the vast majority of retail investors don't deal "face-to-face", or even mask-to-mask. They either deal online or pick up the phone. According to a survey by the Government-backed Investor and Financial Education Council in Jun-2019, only 1% of individual investors most often dealt "physically at the brokerage", while 65% most often dealt online and 33% most often dealt by phone to their bank or broker. In a 12-month period, only 5% of retail investors dealt face-to-face even once - and most of them would be at a bank, not a broker:

You have to wonder who in the Financial Services and Treasury Bureau (FSTB) made up these false reasons and who told them to mislead LegCo in this way. The claims are easy to check, and the FSTB either knew or should have known that the statements were false. That is, they were either lying or reckless to the truth. Did they really think we wouldn't notice?

Legislators should demand to know how these false and misleading reasons were put together, and the HKSARG should apologise to LegCo for misleading its members into approving this part of the package. The only saving grace is that the broker handout totals only about HK$39.5m, but there is a principle at stake.

Incidentally, each firm, assuming it makes no net layoffs during this lucrative period, can also benefit from the up-to HK$54k per-job entitlement to the crazy-but-take-it Employment Subsidy Scheme (see Employers must eat this free lunch, 9-Apr-2020).

© Webb-site.com, 2020

Organisations in this story

- CHINESE GOLD AND SILVER EXCHANGE SOCIETY (THE)

- HKSAR Election Committee

- HKSAR Financial Services and the Treasury Bureau

- HKSAR Legislative Council

- HONG KONG FUTURES EXCHANGE LIMITED

- STOCK EXCHANGE OF HONG KONG LIMITED (THE)

Topics in this story

Sign up for our free newsletter

Recommend Webb-site to a friend

Copyright & disclaimer, Privacy policy