The Budget and HK's Road to Serfdom

26 February 2021

The Government's madcap handout of so-called "Consumption Vouchers" of HK$5,000 to each Permanent Resident and "new arrival" (from the Mainland), at a total cost of HK$36bn, is just another warning sign along the economic Road to Serfdom that the Government seems hell-bent on pursuing, driving the budget to a structurally higher level in breach of the Basic Law requirement to "keep the budget commensurate with the growth rate of its gross domestic product" (Article 107).

The Financial Secretary Paul Chan Mo Po said in the Budget Speech:

"In view of the current special situation, the Government should make good use of the fiscal reserves to energise the market, stimulate the economy, and facilitate the speedy recovery of the consumption market and other economic segments in a timely manner. After careful consideration, I will issue electronic consumption vouchers in instalments with a total value of $5,000 to each eligible Hong Kong permanent resident and new arrival aged 18 or above, so as to encourage and boost local consumption. This measure, which involves a financial commitment of about $36 billion, is expected to benefit around 7.2 million people. The Government will identify suitable stored value facilities operators to help roll out the scheme, and will announce the details of the scheme as soon as possible."

It was clearly added to the budget at the last minute and is not a fully-developed plan. Subsequent reports say the handout will be $1K per month which expires each month. The "vouchers" can be spent with offline or online local merchants, including but not limited to restaurants and supermarkets, but not overseas merchants. Our bet is that this is NGTH - Not Going To Happen, and will be replaced with a simple cash-to-bank scheme like last year's, for the following reasons:

- Assuming that the vouchers are not restricted to particular merchants or narrow sectors, $1000 is highly unlikely to be more than a typical individual would spend on food each month, whether at the supermarkets or eating out. Therefor, the voucher is as good as cash, because it will simply substitute for cash that an individual would have spent on the same items. The cash displaced can then be put to other uses - saving, spending (including overseas online), donating etc.

- There is already an established channel from last year's $10,000 "Cash Payout Scheme" via the banking system. Since the vouchers will displace cash spending, it would be simpler and cheaper to distribute the money to bank accounts.

- The Financial Secretary has suggested that an Octopus Card would be suitable for the voucher - but an Octopus Card, on its own, is a very simple stored-value card and doesn't have the ability to hold a silo of funds for a restricted purpose. You would need to use a smartphone app (such as the Octopus App) for that, and even then, the software of the app may require customisation. Also, if the Government transfers money to an Octopus Card, then it is a relatively simple matter to transfer it back to your bank account via the Octopus Wallet on a smartphone.

- Not every person, particularly amongst the elderly, uses a smartphone.

The handout is a wasteful use of HK's fiscal reserves, because it sprays money at the entire population, rich or poor. Over 90% of the workforce is still employed and in roughly the same financial situation as before COVID-19 - except that they haven't been spending much on foreign holidays and less on bars, gyms, cinemas, restaurants and other things that have been periodically closed by Government order.

The HK$36bn handout is a significant chunk of money, about 1.3% of estimated GDP for 2021-2022, adding to the $72bn cost of last year's handout. So as its expenditure grows, the Government reaches for an easy target and jacks up stock market stamp duty by 30% - raising roughly an extra $13bn per year (depending on market turnover).

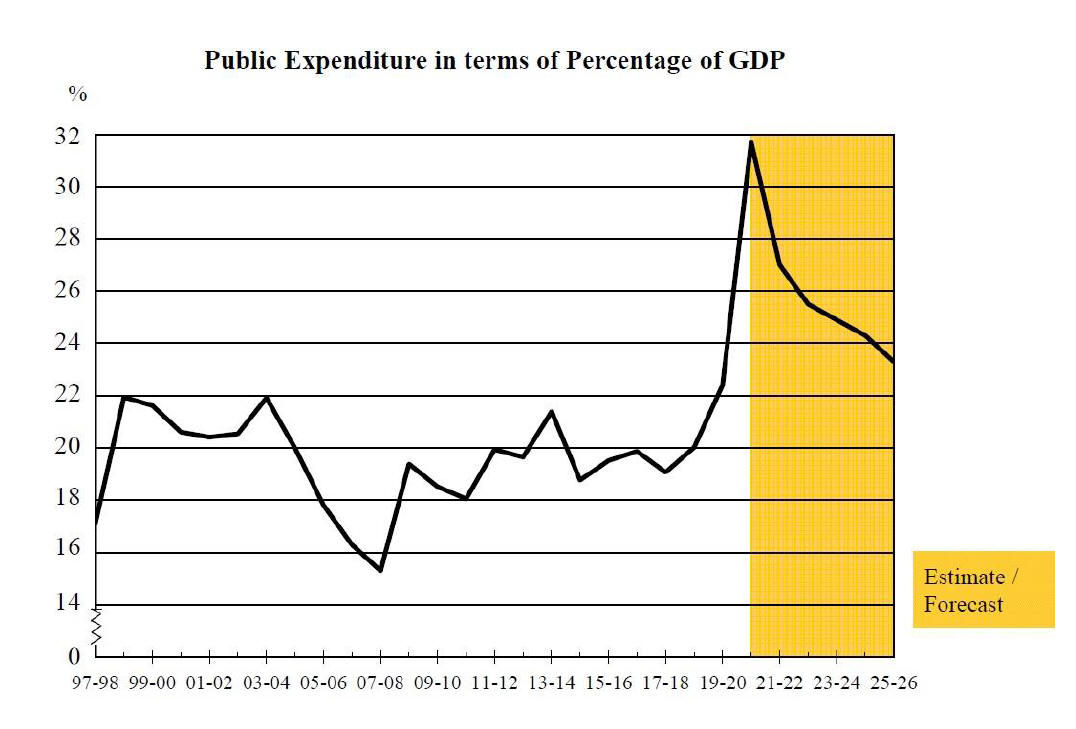

Below is a chart from this year's Budget of the ratio of budget to GDP since the 1997 Handover. It has increased from about 18.4% in 1997-98 to 22.6% in 2019-20, 31.7% in 2020-21 and a projected 27.0% in the current budget. Even 4 years down the road in 2025-26, the spending target is 23.3% - an increase of more than a quarter relative to GDP, since the Handover, breaching Basic Law Article 107.

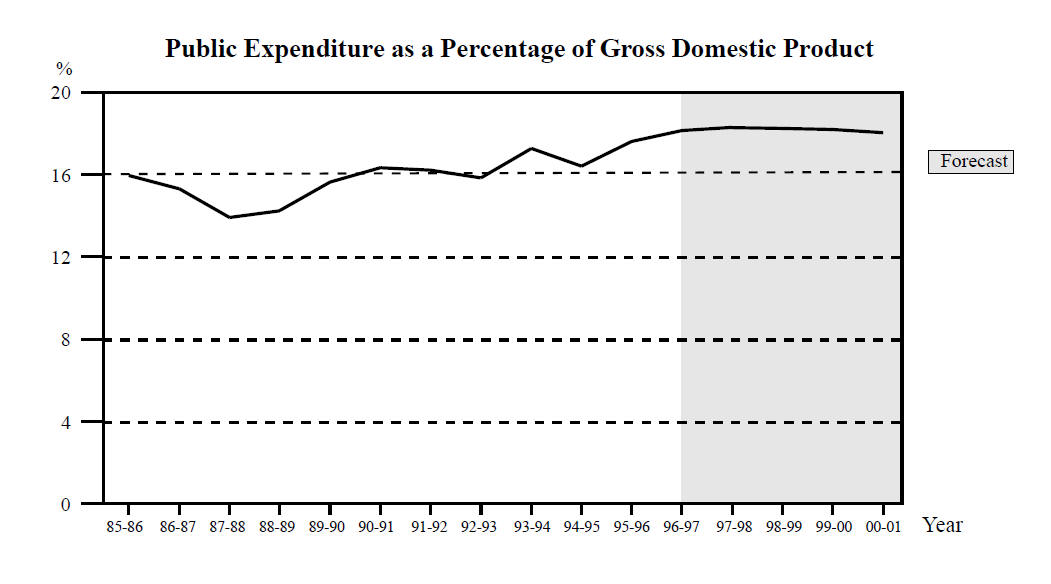

By comparison, here's the same graph from the 1997-98 Budget Speech - notice how the upper bound of the graph is 20%:

There's actually no reason why HK couldn't balance its books this year and next, but that would be involve being far more sensible, focusing on the needy, stopping needless handouts to the needless, and also stopping wasteful interventions to push the economy in one direction or another with subsidies for "re-industrialization" or "innovation and technology". amongst others.

Just a small example - in the amazing-but-true sections of the budget, you will find a plan to pay property tycoons a subsidy of HK$8m for each Real Estate Investment Trust (REIT) that they create for the stock market. Yes, really. Whatever next - a subsidy for launching IPOs? There are continued subsidies for bond issuers (para 75), so it seems that equity subsidies can't be far away. Why not just let the free market function?

Set aside the political issues of the last 2 years. What's really happening is an ongoing slide towards big-budget central planning, mainland-style, far from the free market approach that powered HK's economic growth in the past.

© Webb-site.com, 2021

People in this story

Topics in this story

Sign up for our free newsletter

Recommend Webb-site to a friend

Copyright & disclaimer, Privacy policy