Stop the Scripless U-turn

30 April 2019

To: The Securities and Futures Commission (SFC) and

The

Financial Affairs Panel, HKSAR Legislative Council

Introduction

This submission responds to the recent and misleadingly-titled "Joint Consultation Paper on a Revised Operational Model for Implementing an Uncertificated Securities Market in Hong Kong". This is not so much a "revised operational model" as a wholesale destruction of a model that has already been legislated, reversing benefits that were first advocated by a Government-appointed committee 31 years ago.

The paper claims that after 13 years of previous consultations culminating in legislation that was passed in 2015, the split-register model, which has worked in other jurisdictions, is unworkable in HK. The paper claims that new but unattributed "market concerns" mean we must now retain a single nominee for all shares in the clearing system, entrenching an HKEX rent-seeking monopoly as a layer in the custody chain and denying legal title and the accompanying shareholder rights to those who wish to hold shares available for sale in the clearing system.

We urge Legislators to reject this post-legislative U-turn, which would require fresh legislation, and we urge the SFC to push ahead with the legislated model. After extensive discussions with the SFC and HKEX since the consultation paper was published, we can assure you that they have been unable to identify any legitimate concerns that cannot be addressed within the legislated model. Furthermore, virtually every operational and financial aspect of the existing clearing and settlement system would be undisturbed by the legislated model, leaving minimal implementation expenses for the small brokers who have an outsized political influence in Hong Kong, so you shouldn't worry on that count either.

Investors have been kept in the dark for 4 years since legislation was passed, and it now appears that their rights were being negotiated away behind closed doors, for no benefit.

Background

Few things in Hong Kong, with the possible exception of democracy and electronic road pricing, have taken so long and yet still seem so far away as a scripless or "uncertificated" securities market (USM). To find the first official proposal you have to go back not to the Global Financial Crisis of 2008, nor the Asian Financial Crisis of 1997-8, but all the way to the global crash of Oct-1987, when HK famously shut its markets for a week amid a looming default in the Futures Exchange.

Following that, on 16-Nov-1987 the Government appointed the Securities Review Committee (SRC) to review the operation and regulation of the Hong Kong Securities Industry. On 27-May-1988 the SRC, chaired by Ian Hay Davison, delivered its report, often cited as the "Hay Davison Report". Amongst other things, it led to the establishment of the SFC. In Chapter 5 you will find, after extensive analysis of the alternatives:

"5.116. We believe that, given the importance of disclosure and transparency in shareownership, Hong Kong should so far as possible avoid adopting measures which would reduce the number of direct company shareholders.

5.117. We therefore recommend that the central clearing and settlement system should be built on a system of uncertificated book-entry transfers, with the clearing house's transfers being valid instruments of title."

Of course, that transparency is a two-way street: intermediaries often won't tell you about shareholder meetings, and getting someone else to vote your shares on your behalf makes voting much harder. The greatest benefit of a USM is not that it avoids the issue of paper certificates, but that it should give people full shareholder rights on an electronic register of members (ROM), while at the same time keeping their shares available for sale at the press of a button.

Immobilised certificates

Unfortunately, when the Central Clearing and Automated Settlement System (CCASS) was launched in 1992 along with its operator Hong Kong Securities Clearing Company Ltd (HKSCC), it didn't go that far. CCASS is a depository system, with immobilised share certificates in the name of a subsidiary, HKSCC Nominees Ltd (HKSCCN) which, to this day, is the only registered shareholder, and therefore the only holder of shareholder rights, in respect of any share which is in the clearing system and saleable on the market operated by the Stock Exchange of Hong Kong Ltd (SEHK).

The vast majority of the public float of all companies is held in CCASS by its "Participants" including custodians, brokers, and to a smaller extent, several thousand Investor Participants (IPs) including our editor. An IP acts as her own custodian, not having to trust brokers or banks with the custody of her shares, but keeping the shares in the system and therefore holding them via HKSCCN.

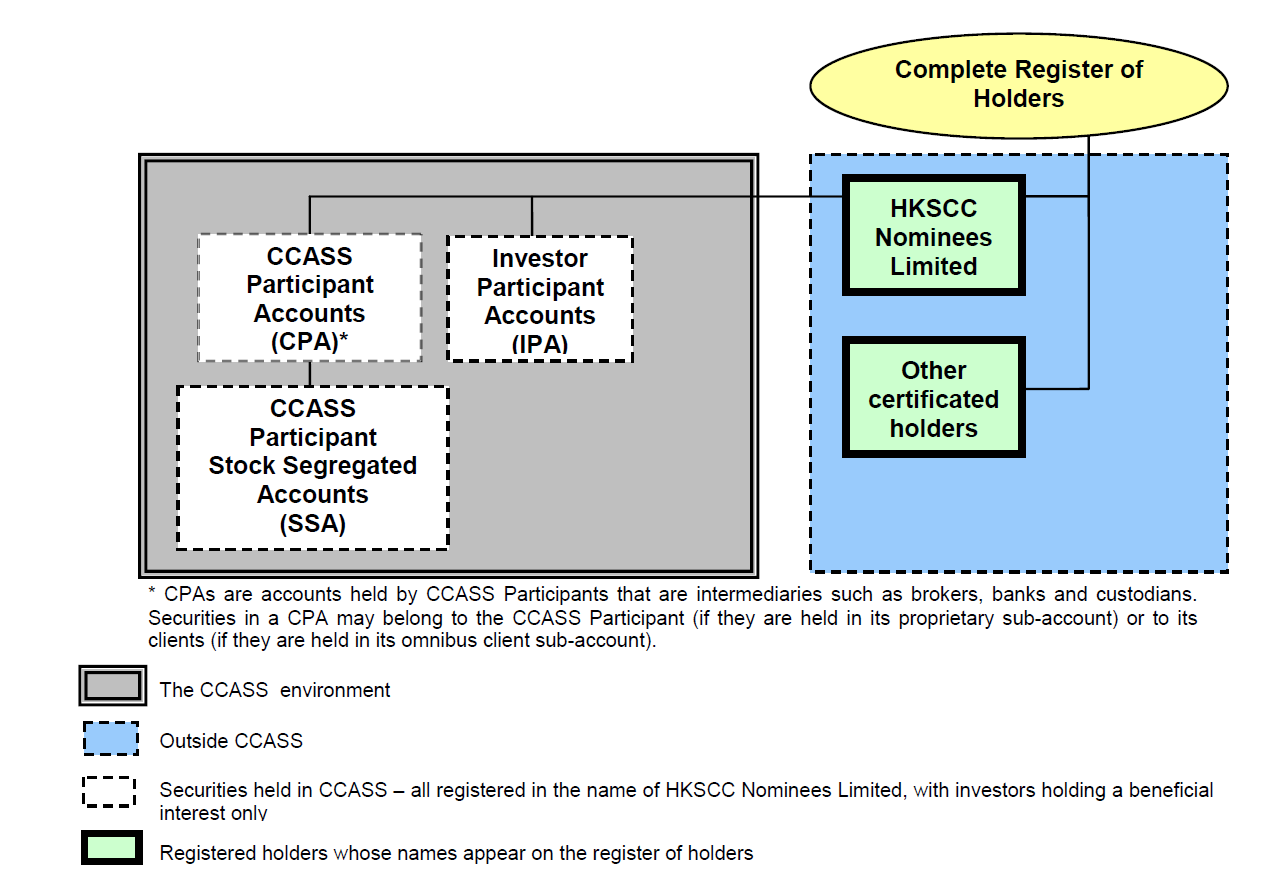

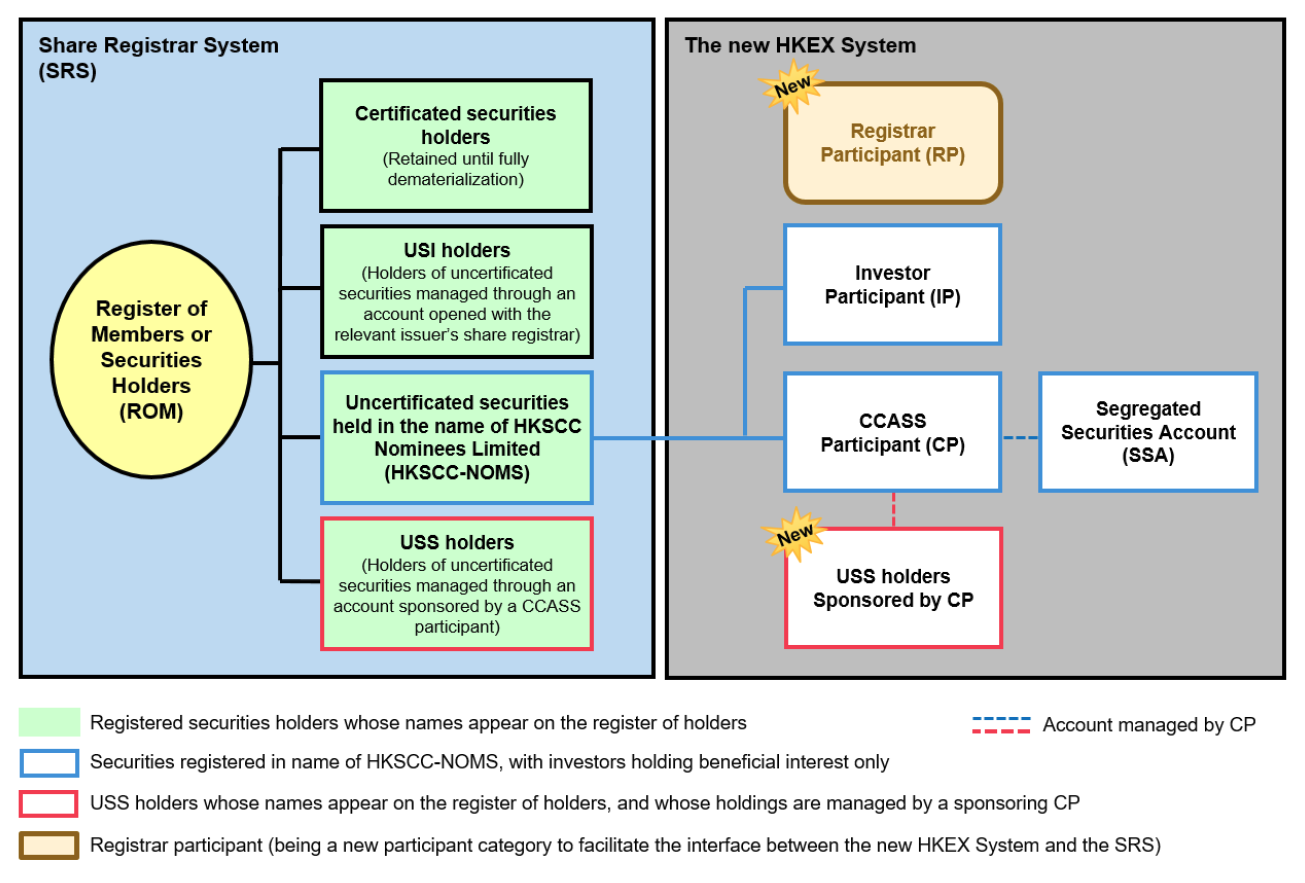

After the CCASS launch, shares within the public float rapidly came into CCASS and were transferred to HKSCCN, to be available for settlement of trades, reducing the number of shareholders as the SRC had feared. The current structure looks like this (all images in this article are from SFC/HKEX consultation papers/web site):

We pause to note that HKSCC started out as a not-for-profit company, and as its volumes grew, its tariff was progressively cut in order not to start hoarding profits (incidentally, unlike the .HK domain registry). Those progressive price-cuts came to an end in 1999, when the Government threw HKSCC into the merger with SEHK and the Hong Kong Futures Exchange, making it a for-profit subsidiary of Hong Kong Exchanges and Clearing Ltd (HKEX, 0388) which was listed on SEHK in 2000. To take just one part of its fee tariff: HKSCC cut its stock settlement fee by 80% between 1992 and 1999, but has frozen it since it became for-profit. HKEX continues to milk the HKSCC cash cow, and has a fiduciary duty to its shareholders to do so. The Government has exempted HKEX and its subsidiaries from the Competition Ordinance, so it is free to abuse its monopolies, although it requires SFC approval for any price increases.

The merger and subsequent government control of HKEX sprang from the Asian Financial Crisis which rolled through Hong Kong in 1998. In a panicked response to pressure on the Hong Kong dollar peg, the Government intervened in the stock market, deliberately bidding up prices of index members to hurt those who had sold futures contracts and bet against the currency, but in the process forever soiling the market with the moral hazard of intervention.

However, they got more stock than expected, about 15% of the public float, partly because short-sellers were not forced by HKSCC to settle on the usual T+2. Afterwards, in the Mar-1999 budget (para 46-51), then-Financial Secretary Donald Tsang set about bringing the whole infrastructure under Government control to avoid a repeat. At the same time, he appointed the Steering Committee on Enhancement of Financial Infrastructure (SCEFI), led by then-SFC Chairman-CEO Andrew Sheng Len Tao, to look at:

"the infrastructure requirement for straight-through processing, e-commerce through internet trading and a fully scripless market for Hong Kong"

The first SECFI report, dated Sep-1999 and released on 12-Oct-1999, 11 years after the SRC report, again recommended moving towards a scripless securities market. It also recommended a single clearing arrangement for stocks, futures and options - something which never happened; only futures and options were combined into DCASS in Apr-2004. Of course, any futures contract is mathematically equal to holding a long call option and a short put option at the same strike price and expiry date.

Consultations on scripless

After the SCEFI report, there then followed a series of consultations and conclusions:

- On 4-Feb-2002, an SFC consultation paper on proposals for a scripless securities market.

- The SCEFI band came back together for a sequel, the SCEFI II report, dated Aug-2002 but published on 9-Dec-2002, which mentioned the ongoing scripless proposals.

- On 30-Sep-2003, the SFC's conclusions paper was published. It concluded (as proposed) that there would be a 2-part "split-register" model, with the existing CCASS ledger becoming the "CCASS Register" and the other part being the "Issuer Register" maintained by the issuer's registrar. For a transitional period, the issuer and its registrar may continue to allow certificated shares on the Issuer Register. The conclusion looked like this:

- On 24-Oct-2003, an HKEX consultation paper on a "Proposed Operational Model for a Scripless Securities Market". This paper went deeper into the mechanics of the split-register model. The SFC had formed a Scripless Implementation Working Group, a Scripless Model Technical Working Group and 3 focus groups. The members included the Federation of Share Registrars (FSR), brokers, custodians, issuers and HKEX.

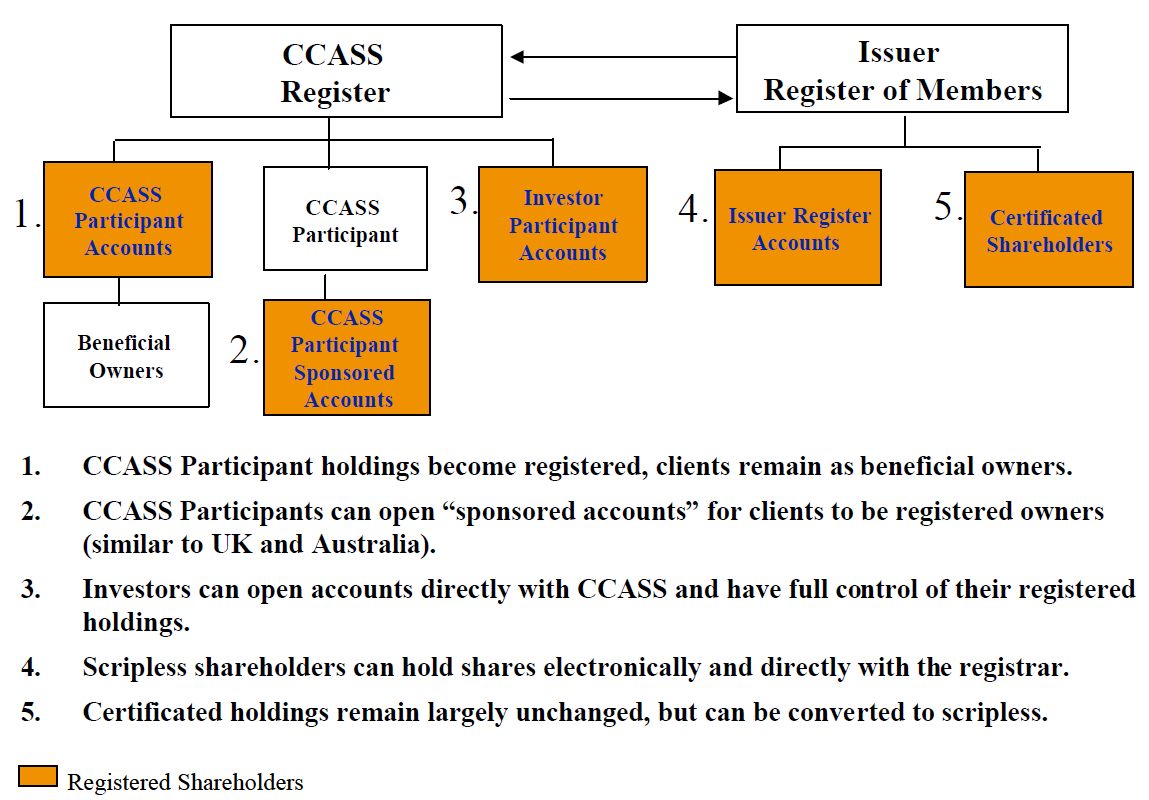

- On 31-May-2004, an HKEX conclusions paper. This self-interested outcome proposed reverting to a single register of members, and keeping all CCASS holdings in the name of HKSCCN, basically throwing out the main benefit of an uncertificated securities market. The only residual benefit was that HKSCCN would no longer need to maintain a physical vault full of share certificates, because it could hold scripless securities on the register. To understand the vested interests of HKEX, you need to know that HKSCC collects fees on dividends which are paid to HKSCCN before distribution to Participants, fees on custody of the shares, and a "registration and transfer fee" on net increases in CCASS Participant balances between book closure dates for distributions. A user-friendly explanation is here. There are a range of other fees such as a "corporate action fee" to take up rights issues. So after being butchered by HKEX, the proposed USM model was this (yes, even the colours are sickening):

- Then there was a gap of over 5 years, while the SFC and HKEX presumably jostled for position, with the SFC wanting to do the right thing and HKEX wanting to do the vested-interest thing.

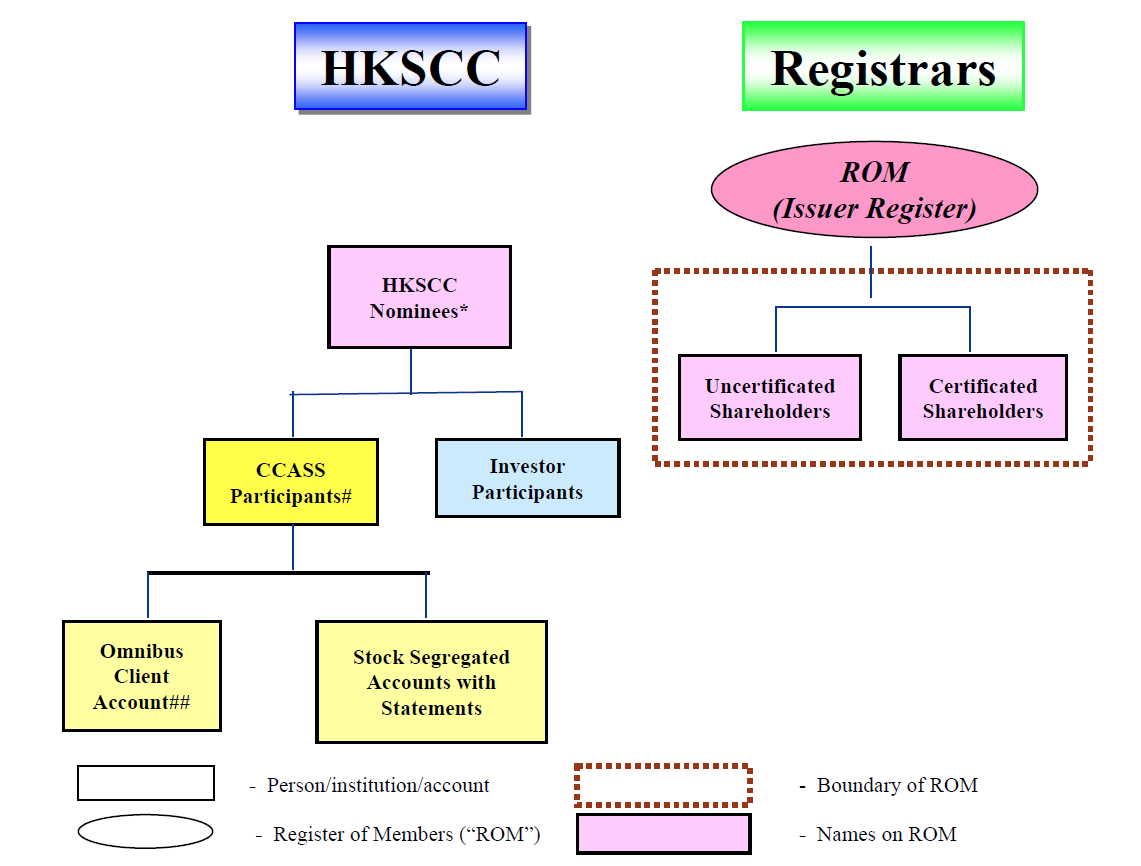

- On 30-Dec-2009, a joint SFC-HKEX-FSR consultation paper on "A Proposed Operational Model for Implementing a Scripless Securities Market" basically reversed the HKEX decision and relaunched the split-register model, giving renewed hope that people could hold shares within CCASS and at the same time enjoy the rights of a registered shareholder. The only and minor difference to the 2002 proposal was that the registrars would have their own accounts within CCASS, for shareholders who wanted to hold uncertificated shares with the registrar (an "Issuer Sponsored Account" rather than with a broker or custodian (a "Participant Sponsored Account"). This would mean that only certificated shares would be held outside CCASS. This is a minor difference because, either way, the registrar and CCASS databases still need to be synchronised to allow movements between them, at least until certificated shares are finally abolished.

- A conclusions paper on 21-Sep-2010, deciding to go ahead as proposed, with minor changes. This model, now known as the "2010 Model", then moved into its legislative phase. It looked like this:

- In Jun-2014, after four years of feverish drafting in obscurity, the Government introduced a bill to the Legislative Council (LegCo), and a Bills Committee formed to consider it. The Bill was passed as the Securities and Futures and Companies Legislation (Uncertificated Securities Amendment) Ordinance 2015 and gazetted on 27-Mar-1015. The key part of this law is to introduce legal title to holders of shares in an "uncertificated securities market system" operated by a "system operator" (in the first instance, HKSCC) under the Uncertificated Securities Market Rules (USMR) which would be made as subsidiary legislation by the SFC. It splits the register of members into 2 parts, a "members register (certificated shares)" and a "members register (uncertificated shares)". The law also provides for application to corporations domiciled overseas as long as the law of their place of incorporation doesn't conflict with it. That's important because about 91% of HK-listed companies are domiciled outside HK.

What happened next?

That history takes us up to 2015, a mere 27 years after the SRC Report, and all that remained is for the systems to be put in place, databases connected, and the SFC to publish, consult upon, and conclude the subsidiary legislation. At Webb-site, we sat back, believing that after not one but 3 different consultations and legislative passage, it was just a matter of time before we finally get shareholder rights in the clearing system. In its 2015 annual report, the SFC wrote:

"The Securities and Futures and Companies Legislation (Uncertificated Securities Market Amendment) Ordinance 2015, enacted in March 2015, will allow investors to legally hold and transfer listed securities in a paperless form. We plan to begin a consultation on subsidiary legislation which sets out technical and operational details of the new regime in 2015."

That didn't happen, but no worries, in the 2016 report they wrote:

"we are working with HKEX on a review of the current clearing and settlement arrangements. One objective is to identify changes that may be needed to implement an uncertificated securities market, where legal title to securities may be held and transferred electronically. A formal consultation on the proposed changes will be conducted if necessary."

OK, no mention of subsidiary legislation, but in 2017 report they wrote:

"In preparation for the introduction of a paperless securities market, we are reviewing clearing and settlement arrangements with HKEX to identify the changes needed and the potential impact on market participants."

Hey, what about the impact on investors? We're getting old waiting. Then in the 2018 report they wrote:

"We are also working with key stakeholders to identify the changes needed to implement a paperless securities market and plan to consult on the proposed operational model in 2018."

Shocking U-Turn

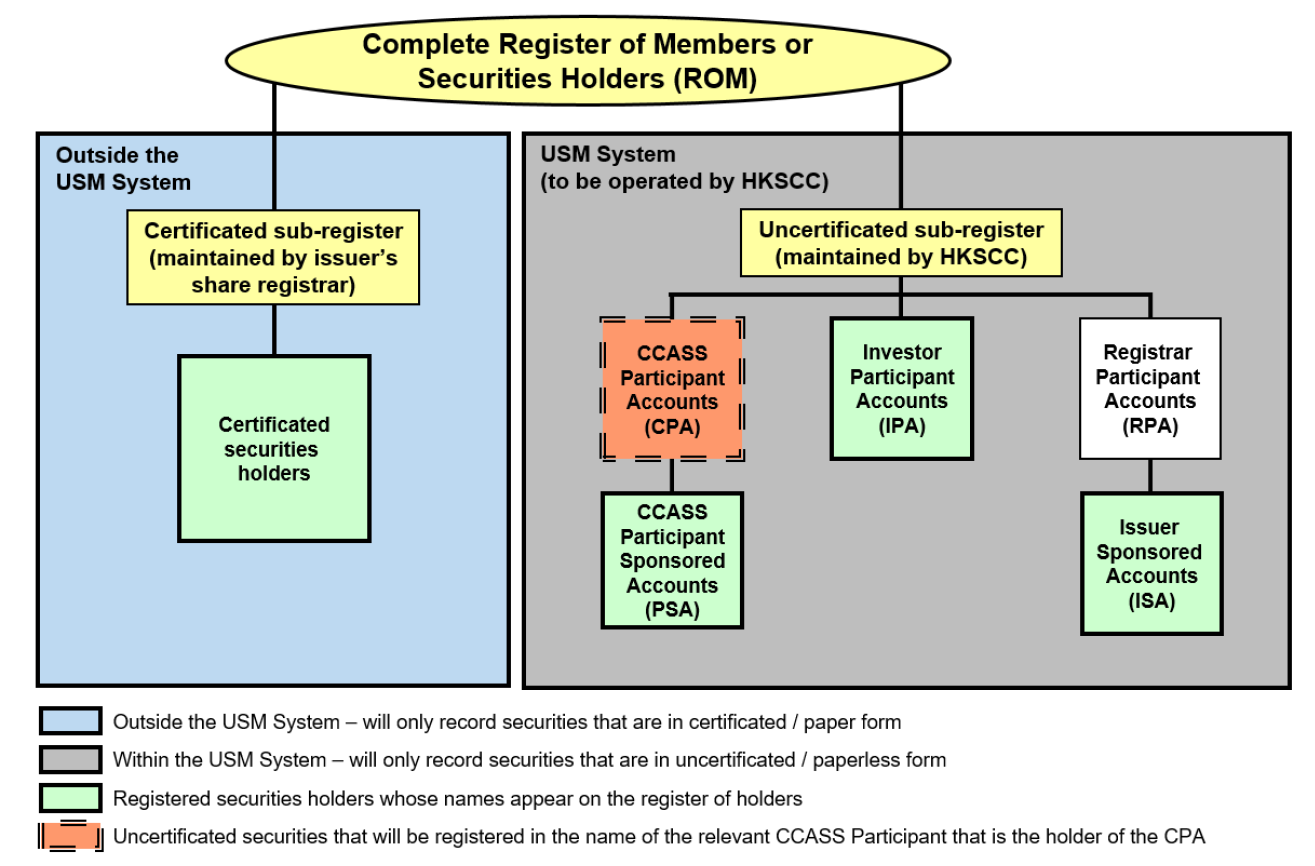

After keeping investors in the dark for nearly 4 years, on 28-Jan-2019, the regulators shocked us with a joint SFC-HKEX-FSR consultation paper which basically proposes to pull the plug on 31 years of development, or at the very least on a system that had been designed, consulted upon (thrice) and subject to legislative scrutiny over a combined 13-year period from 2002 to 2015. Pitched as a "revised operational model", this is in reality a U-turn, taking us back to the HKEX conclusions of May-2004 in which HKSCCN would continue to operate as a nominee shareholder on behalf of all CCASS Participants, skimming fees off the book and denying investors their long-awaited shareholder rights within the CCASS system (but see below). The 2019 proposal looks like this:

Despite every conceivable opportunity since 2002 for deal-breaking technical objections to be raised, the trio now discovered (para 6) that:

"Subsequently however, in the course of developing the details of the 2010 Model, market concerns were raised about the limitations of that model. Specifically, there were concerns that the model would compromise certain settlement efficiencies currently enjoyed by market participants, and have a significant impact on their liquidity needs. In view of this, we have had to revisit the 2010 Model and identify an alternative approach."

Now Webb-site is nothing if not rational and reasonable, so we have kept quiet on this while your editor met with the SFC and HKEX (together) twice since the paper was published, to ascertain whether there is any legitimacy to these so-called "market concerns" (the source of which has not been identified), that is, anything that cannot be addressed within the 2010 Model.

After several hours of discussion, we can assure you, Dear Reader, and Dear Legislator, there are no legitimate concerns, only a baseless fear of change at the SFC, and opposition from HKEX which has a vested financial interest in the status quo.

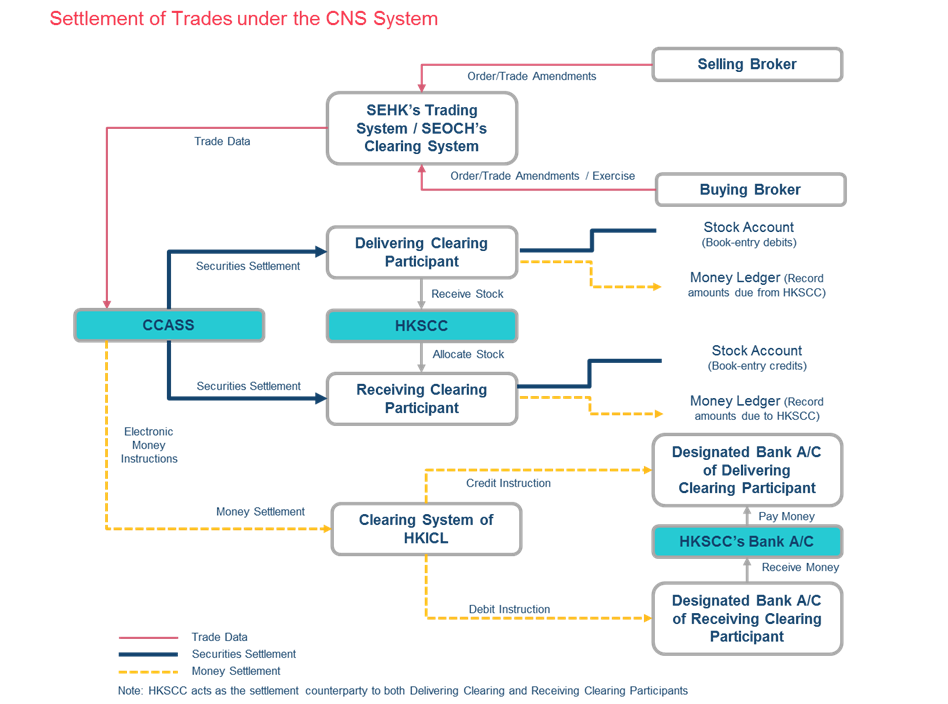

In CCP We Trust

The entire market has, since CCASS was introduced in 1992, operated on the basis of "In CCP We Trust". Not the Chinese Communist Party (one could debate that), but the Central Counter-Party (CCP) which is HKSCC. What actually happens when you trade shares on the HK exchange is that your contract is "novated" into two "Market Contracts", one in which the selling participant sells stock to the CCP, and one in which the buying participant buys stock from the CCP. All transactions between the CCP and the same participant in the same stock on the same day are netted off, leaving a net stock balance to be transferred to or from the CCP. Similarly, all payment obligations on the same day are also netted, which reduces the liquidity needs of the brokers and other participants, leaving a net payment to be made to or from the CCP.

So for example, clients of broker-A may have collectively bought and sold large amounts of stock-B, but it is the net purchase or sale that gets settled with CCASS, and if the broker is a net seller, it delivers shares in stock-B to the CCP. Across all its securities transactions, it might be a net buyer, and owe money, or a net seller, and receive money from the CCP. This system for on-market transactions is called the Continuous Net Settlement (CNS) System, illustrated in this HKEX diagram:

There is a stage in CNS when interests in shares are delivered by CCASS Participants to the CCP, but before the CCP actually pays the Participant any net cash that it is owed. The CCP has to be trusted to honour its payment obligations, and also to release shares to the receiving Participant upon payment. Given that the CCP is also the operator of CCASS which records all the movements of these interests in shares, it has a dual role anyway.

And why do we all trust the CCP? Because it is financially well-endowed with security deposits from broker-participants, by its own capital, by capital of its parent (HKEX) and ultimately by the political reality that it is systemically too important to be allowed to fail. If, for some bizarre reason, HKSCC couldn't settle its obligations, the HKSAR Government would have to step in with a lifeboat loan to avoid a catastrophic failure of HK's only stock market. The details of the risk management measures are on the HKEX site.

The "market concerns"

The transfer of legal title on a share register is final (unless by court order). In law, the issuer of the shares only has to recognise its registered shareholders and nobody else. Any arrangement between the registered shareholder and a third party, often a nominee relationship, is of no concern to the issuer. The purported "market concerns" revolve around:

- Under the current system, there are certain stages in the clearing and settlement process when shares are placed into a recipient account but marked "on-hold" until payment is made. Payment can be made early, and the shares unlocked, if the buyer wants to gain access to the stock, using a cash pre-payment instruction.

- As mentioned, there is also a stage in the CNS when interests in shares are delivered by CCASS Participants to HKSCC as the CCP, but before the CCP actually pays the participant any net cash it is owed.

To resolve point 1, the way that a receiving Participant knows that share are available but on-hold is by making an electronic enquiry through its CCASS terminal. Under the 2010 Model, the result of that enquiry would need to show shares which are now available, but still held by HKSCC as the CCP until the payment obligation is settled. That avoids transferring title from HKSCC to the recipient until payment has been made. The recipient, as always, has to trust the CCP that it will actually release the shares upon payment.

On point 2, in the present system, what the delivering participant transfers to the CCP is interests in shares held by the participant via HKSCCN. In the 2010 Model, the participant would transfer legal title to shares on an electronic register. In either case, there is a theoretical but remote risk that the CCP (HKSCC) will default on payment, and the Participant ends up with a debt owed by its novated counter-party, HKSCC. The introduction of scripless registration removes one layer of the nominee system (HKSCCN), but it doesn't change the financial risks of the parties involved, however remote. So the concern is a false one.

The same can be said of a transfer by a custodian or an investor participant to a broker for settlement of a sale, or in anticipation of a sale. When an intermediary (usually a broker) collapses, as Peregrine, Lehman and C.A. Pacific did, any shares they hold on trust for their clients will be at risk, regardless of whether those shares are held as interests via a nominee (HKSCCN), or directly on a share register. Assets held for clients won't be the broker's assets in a liquidation, but there is always a risk of expropriation (theft). Whether and how much you trust your broker (or even your custodian) is up to you, and the 2010 Model does not change this.

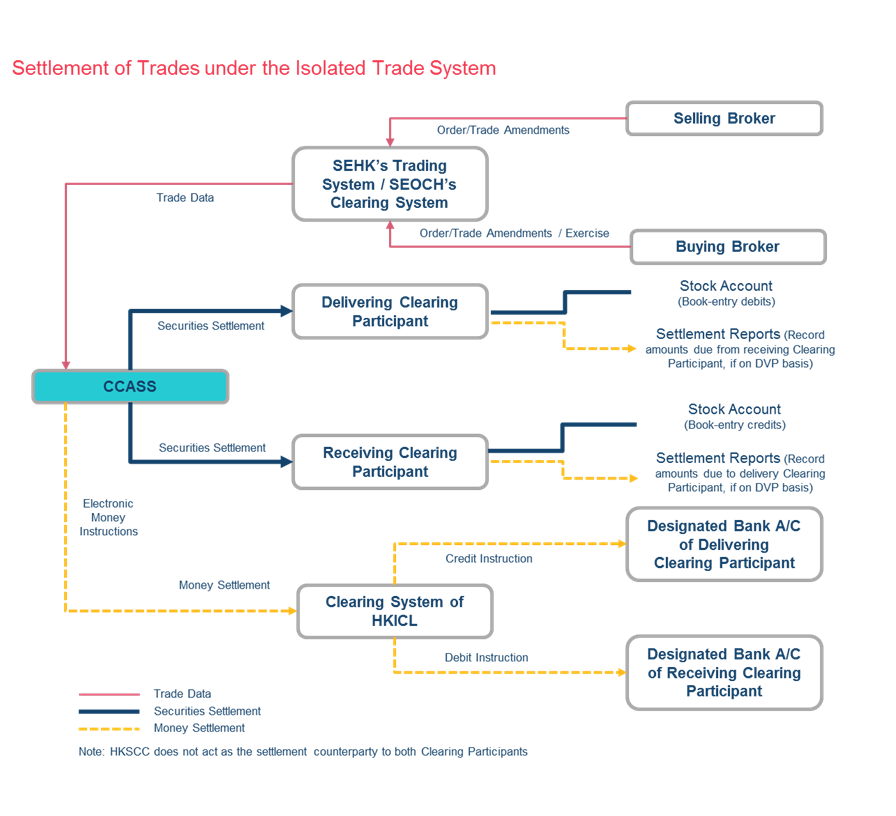

Non-CNS transactions

For off-market transactions outside of CNS, any payment arrangements are a private matter between the buyer and seller, and if they wish to involve HKSCC, they can. Currently, off-market transactions can be settled Free Of Payment (FOP), or directly inside CCASS between the Participants using a Settlement Instruction (SI), but to ensure payment, even with so-called Delivery Versus Payment (DVP) or even "Real-time" DVP (RDP), there is an "on-hold" mechanism to lock the shares until payment is received, because it isn't instant. The process is illustrated in this HKEX diagram of the "Isolated Trade System":

There's really no such thing as real-time. Think of two people standing in a market, one holding a share certificate and one holding a bank note. Each grabs hold of one end of the other's paper. Who let's go first? The answer is to use a trusted intermediary, in this case, HKSCC, in effect, an escrow agent.

Under the 2010 Model, the transfer of share title to the buying Participant would be irreversible, so it must be the final step. The way to address that is, once again, for the selling Participant to trust HKSCC, but this time not as principal. The SI would cause shares to be transferred to HKSCC as nominee (agent) of the seller. The shares would then be released to the buying Participant upon confirmation by HKSCC of payment, failing which the shares would be transferred back by HKSCC (as nominee) to the selling Participant. This replicates the current "on-hold" system - the financial risks are the same, and the 2010 Model changes nothing in that respect.

Summary

If you've made it this far, then congratulations - you probably understand the 2010 Model better than some of the people trying to reverse it. To summarise, under the existing nominee model:

- HKSCCN always holds legal title to all the shares in CCASS. Participants have no shareholder rights.

- As nominee, HKSCCN holds shares on trust for every CCASS Participant.

- In CNS, a net-selling (delivering) CCASS Participant transfers interests in shares to the CCP (HKSCC) and trusts it to pay.

- A net-buying (receiving) CCASS Participant can get shares early if it pays early. It trusts the CCP to deliver upon payment.

- Off-market transactions, if settled in CCASS, involve HKSCC placing an "on-hold" lock on the shares until payment is confirmed, when they are released to the recipient.

Under the 2010 Model:

- CCASS Participants would hold legal title to shares, with full shareholder rights.

- HKSCCN would become redundant.

- In CNS, a net-selling (delivering) CCASS Participant transfers title to shares to the CCP (HKSCC) and trusts it to pay.

- A net-buying (receiving) CCASS Participant can get shares and title early if it pays early. It trusts the CCP to deliver upon payment.

- Off-market transactions, if settled in CCASS, involve HKSCC receiving title as the nominee of the selling participant, until payment is confirmed, when it transfers the shares to the buying participant, replicating the current "on-hold" system.

In short, there is nothing about the 2010 Model, as legislated, that changes the financial risk profile at any stage of any transaction. The clear advantages of the model first advocated by the Hay Davison report in 1988, with title and shareholder rights on an electronic register in CCASS, must be retained and not thrown away to satisfy powerful vested interests.

Half-baked measures

As you may have spotted in the last diagram above, the proposal does include a half-baked fudge to this self-induced mess. They propose that CCASS Participants, including brokers and their clients, should stay in the nominee system, but "institutional" investors would be allowed to have legal title to uncertificated shares via a sponsoring custodian in a "USS" account in "the new HKEX System". Registered USS shareholders could then electronically transfer shares into CCASS (back into the nominee system) for sale or to settle transactions. In other words, giving institutions a privileged status, and going half-way back to the split register, but only if the custodian offers that service, and for unknown fees.

For individual investors, the 2019 proposal only offers legal title via a "USI" account with share registrars, outside of the HKEX system altogether. Each time an investor wants to transfer shares into CCASS for possible sale, or out of CCASS to get onto the register, there would likely still be fees payable to both HKSCC and the registrar, and time involved in doing so.

Why this matters for corporate governance

Shareholder rights are important. You can never get HKSCCN to lift a finger to exercise those rights, other than voting at meetings. If you want to requisition a general meeting, propose a director for election, requisition a search of ownership, or petition the court for a winding up, then you need to move shares onto the register, and that may not even be possible if the registers are closed for transfers, including during a provisional liquidation. Some laws also have a minimum holding period on the register before action can be taken. So the USI account is no alternative and even the USS account looks like a desperate attempt to buy off the institutions and separate them from individual investors. In any case, it is likely to be so complicated that custodians either won't offer it or will discourage clients from using it.

Inspection of the register

There's one more thing: Currently, an IP has to consent if he wants his holding to appear on the online list of CCASS holdings. In the 2010 Model, IPs would have legal title on the CCASS sub-register, but it would not be fair for changes in their balances to be visible day-by-day as they trade. We already have the Disclosure of Interests provisions of the law to require disclosure by directors (on each trade) and substantial (5%) shareholders (on each movement through a 1% boundary). So the traditional rights of the public to inspect a share register should be limited to shares on the Issuer Register, outside CCASS. The "non-consenting IPs", as they are currently called, should have their privacy preserved. Similarly, even in the 2019 Model, we doubt that institutions would want the public to be able to calculate their transactions from daily changes in their USS holdings.

It is also long overdue that registrars, which are regulated by the SFC, should be required to put registers online for inspection, instead of having to visit the Hopewell Centre in Wanchai to peer at an offline computer screen.

Not pioneering

In case you are wondering, HK is not exactly an innovator in the scripless field. Australia has had a fully scripless, split-register system since 1999, called the Clearing House Electronic Sub-register System (CHESS). It works well, although they are in danger of replacing it with a distributed ledger system for no obvious benefit. Mainland China has a fully-scripless system operated by China Securities Depository and Clearing Corp Ltd (CSDC), a not-for-profit company established in 2001 and owned 50% each by the Shenzhen and Shanghai Stock Exchanges. HKEX knows how that works and deals with it via "Stock Connect". Hong Kong has waited long enough, and we will be a laughing stock if the SFC goes back to LegCo to ask them to tear up the legislation and start again.

© Webb-site.com, 2019

Organisations in this story

- HKSAR Securities Review Committee (1987 crash)

- HKSCC NOMINEES LIMITED

- HONG KONG EXCHANGES AND CLEARING LIMITED

- HONG KONG SECURITIES CLEARING COMPANY LIMITED

- SECURITIES AND FUTURES COMMISSION

- STOCK EXCHANGE OF HONG KONG LIMITED (THE)

People in this story

Topics in this story

Sign up for our free newsletter

Recommend Webb-site to a friend

Copyright & disclaimer, Privacy policy