The Princeton economist and a plot in Sheung Wan

8 October 2018

Congratulations to Princeton University economist Gregory Chow Chi Chong (Prof Chow), whose extended family has just come into a surprise windfall. We see in a court judgment dated 4-Oct-2018 that Prof Chow recently applied to resuscitate a HK company that was dissolved in 1972, Man Fung Land Investment Co Ltd (MFLI). His late father, Chow Ting Pong, was one of 3 subscribers when the company was incorporated on 19-Sep-1963. Four weeks later, on 17-Oct-1963, Prof Chow was allotted 100 shares (4%) of MFLI, but he was unaware of this until a buyer called him up enquiring about a piece of land in 2017. Prof Chow is now 87.

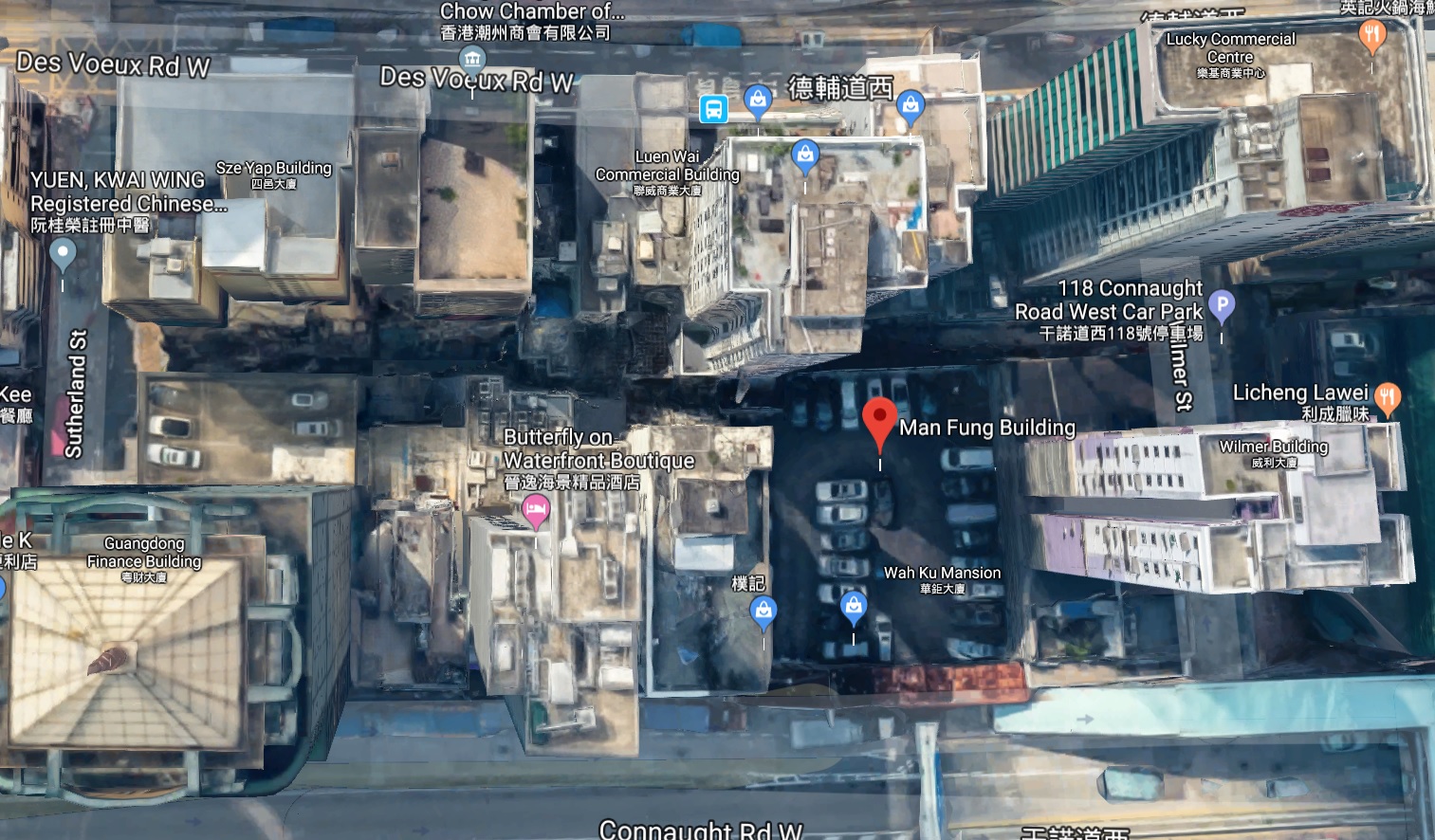

It transpired that on 30-Sep-1963, Marine Lot 479 was assigned to MFLI. Subsequently, for reasons that were not explained in the judgment, it was sub-divided into Section A (SA) and the Remaining Portion (RP). The RP and an adjacent lot were developed into Man Fung Building (MFB), at 101-102 Connaught Road West. All of the units of MFB were eventually sold off, leaving MFLI with just SA, which - get this - measures only 7.25 feet by 15.75 feet - just 114 square feet or 10.6 square metres of land - smaller than a standard 12.5 sq. m. car park space, but we suspect the founders were thinking ahead when they carved off SA and excluded it from the development.

MFLI was liquidated in 1972 without ever selling SA. The directors and liquidator are all dead, and nobody knows why the land was not transferred out before liquidation. The court has now granted Prof Chow's application to revive the company and put it back into liquidation so that the land can be sold.

According to the judgment, the unnamed "Interested Buyer", represented by Mr Amos Chan, "is desirous of buying SA of the Lot for HK$6.5m". We'll bet he is! Allowing for a 15x plot ratio, the site would generate a gross floor area of 1,713 sq. ft., so that would be a price of only HK$3,794 per gross sq ft. We suggest that Prof Chow and his family might want to hold out for more - particularly if the scrap of land is essential to the redevelopment of the adjacent sites, because that is indeed what is about to happen.

Private developer Tai Hung Fai Enterprise Co Ltd (THFE), controlled by Edwin Leong Siu Hung (Mr Leong), between 2009 and 2014 bought up 97.6744% of the shares of MFB. There was only one remaining unit owned by the estate of a man who died in 1984 and whose widow died in 1985 without having proved his will. Also, the unit was said to be held in trust by the man's estate for certain beneficiaries and the executor had agreed in 2011 to sell it to THFE, once the will had been resolved. Proceeding on that basis, MFB was demolished by May-2013. On Google satellite view it now appears as an empty lot with a temporary car park.

THFE then applied to the Lands Tribunal for an auction under the Land (Compulsory Sale for Redevelopment) Ordinance with a reserve price of HK$309m ($81,623 / sq. m. of floor area, or HK$7,583 / sq. ft.), based on a valuation by Savills of the redevelopment value of the site at 17-Feb-2015, and "in the absence of evidence to the contrary", the auction order was granted on 8-May-2015. An auction was held by Savills, and the only bidder was THFE, which won at the reserve price. It's a notable feature of such auctions that developers almost never seem interested in treading on each others toes. They do not contest auctions triggered by the developer who has accumulated most of a site.

Slightly to the East along the same road, 3 years later, on 13-Apr-2018, Kai Yuan Holdings Ltd (1215) sold the Butterfly on Waterfront Sheung Wan hotel (95 Connaught Road West) to THFE via a BVI shell for HK$810m, valuing the building at $21,300/sq. ft., a handy gain having bought it in Dec-2013 for HK$488m. Mingtiandi reports that THFE has now acquired 6 adjacent sites including MFB and the hotel, and is looking to add a plot behind the MFB site on Des Voeux Road West.

On the basis of the hotel site (and remember, they still have to demolish that), SA would be worth more like HK$36.5m, even without any strategic premium if it is key to the site consolidation. So, Prof Chow, consider the economic value!

© Webb-site.com, 2018

Organisations in this story

- Kai Yuan Holdings Limited

- MAN FUNG LAND INVESTMENT COMPANY LIMITED

- TAI HUNG FAI ENTERPRISE COMPANY LIMITED

People in this story

Sign up for our free newsletter

Recommend Webb-site to a friend

Copyright & disclaimer, Privacy policy