Skin in the game

23 June 2009

OK, it's been 12 days since we took you through all the shenanigans around China Railway Logistics Ltd (CRL, 8089) and PME Group Ltd (PME, 0379). Now we'll move on to what became another piece of this network, China Bio-Med Regeneration Technology Ltd (CBRT, 8158).

CBRT started life as "B M Intelligence International Ltd and was listed on 18-Jul-01. It was "principally engaged in the provision of business, accounting and corporate development advisory services to companies in Hong Kong and the PRC". It did not have any accounting licence. It's then Chairman and founder, Lowell Lo Wah Wai (Lowell Lo), also owned 99.99% of Lo and Kwong C.P.A. Co Ltd (Lo and Kwong), an accounting firm, the other 0.01% being held by Alex Kwong Kam Kwan (Alex Kwong), who was also a former shareholder in BMI Consultants Ltd, the main subsidiary of CBRT when it listed. The other executive director and substantial shareholder of CBRT was Barry Ip Yu Chak (Barry Ip). CBRT, in the form of BMI Consultants, was just a 2-man business run by Lowell Lo and Barry Ip until it began hiring staff in Jan-2001, six months before its own listing.

The core of CBRT's pre-IPO track record (the 3 years to 30-Apr-01) consisted of preparing other companies for listing, the accounting work for which was subcontracted to two independent accountancy firms, one in HK and one in Shenzhen. In Aug-1996, CBRT entered into a service agreement with KLL Associates CPA Ltd (KLL), which provided the outsourced HK accountancy services to clients of CBRT. KLL was taken over on 1-Aug-05 by BDO Ltd,, which also subsumed Shu Lun Pan Horwath Hong Kong CPA Ltd on 1-May-09.

In Feb-2001, CBRT entered into a "co-operative alliance agreement" with Altus Capital Ltd (Altus), a corporate finance advisory firm in HK. The CBRT prospectus didn't mention it, but Arnold Ip Tin Chee and Patrick Sun Sai Man, directors of Altus, joined the board of CBRT as NEDs on 26-Apr-01 and resigned on 15-Jun-01, before it was listed. This was revealed in the directors' report for the year to 30-Apr-02.

Also in Feb-2001, CBRT formed BMI Appraisals Ltd (BMI Appraisals), a 50:50 joint venture with Mr Tony Cheng Chak Ho (Tony Cheng), an "independent chartered surveyor...to focus mainly on valuation of intangible assets". In fact Mr Cheng worked until 31-Jul-01 for Sallmanns (Far East) Ltd (Sallmanns), the firm which issued the valuation report in CBRT's listing prospectus on 11-Jul-01. He had failed to tell the senior management of Sallmanns about this. The Disciplinary Board of the Hong Kong Institute of Surveyors (HKIS) issued a report to the General Council which determined that he had "conducted himself in a manner unbefitting a member of the Institute" and resolved to suspend his membership for 2 years from 25-Nov-03.

It's worth reviewing some of CBRT's pre-IPO projects, mostly carried out before its own listing, so you can get some feel for the way the firm did business.

Pre-IPO clients

An early pre-IPO client of CBRT was Sun Hing Vision Group Holdings Ltd (SHV, 0125), which listed on 25-May-99. KLL was the joint reporting accountant on this IPO. The first annual report after listing revealed that Lowell Lo was briefly an INED of SHV from 3-Mar-99 to 23-Apr-99, before the IPO. Perhaps he wasn't considered independent, given his firm's advisory role. He was replaced as INED by his younger brother, Roy Lo Wa Kei (Roy Lo), who still serves. This company worked out alright though, and your editor now holds over 6% of it.

Another pre-IPO client of CBRT was Time Infrastructure Holdings Ltd (TIH, 0686, then "Gay Giano International Group Ltd"), which listed on 13-Apr-00. Although Ernst & Young was the reporting accountant in the IPO, all the subsidiaries' accounts for the first 2 years of the track record were audited by Lo and Kwong, Lowell Lo's firm. During 2000 the stock price was ramped and then collapsed. On 8-Jul-02, Mr Cheung Sing Chi resigned as Chairman of TIH after being charged by the Commercial Crime Bureau. In 2003 he and his brother, Cheung For Sang, were jailed for conspiracy to defraud investors by market manipulation. Barry Ip was an NED of TIH from 12-Mar-01 until he resigned on 21-May-04. On that day, TIH appointed Roy Lo as INED. Ernst & Young resigned as auditors on 24-Jun-03 and were replaced by KLL.

Another CBRT client was Sino-Tech International Holdings Ltd (SIH, 0724), then known as Millennium Sense Holdings Ltd and later notoriously known as Semtech International Holdings Ltd, which listed on 3-Jul-00. CBRT booked fees of $2.04m on pre-IPO advice and a further $2.1m of advice including "performance improvement" and "crisis management" up to Feb-2001. SIH, a maker of cigarette lighters, accounted for 47.2% of CBRT's turnover in the last year before listing. On 8-Nov-00, SIH agreed to subscribe $2m for a convertible note in CBRT, which was converted into 5m shares (1.67%) of CBRT upon its listing and sold for $1.16m in the first half of 2002.

The MD and founder of KLL, Daniel Lee Ka Leung, was an INED of SIH from 1-Jun-98 (pre-IPO) to 18-Jun-01. For more on SIH, the scandals surrounding it in 2004, subsequent convictions, possible options abuse and the missing deposit on a failed Vietnamese chromium mining project, see our side-piece article today. Lowell Lo was appointed as INED of SIH on 27-Sep-04, when the listing rules increased the required number of INEDs to 3.

Another pre-IPO client of CBRT was Vital Pharmaceutical Holdings Ltd (Vital Pharma, 1164), which joined GEM on 7-Feb-02. Roy Lo was an INED of that twice: from 26-Jan-02 (pre-listing) to 2-Jul-02, when he was replaced by Mr Lui Tin Nang (T N Lui, who still serves), and again from 30-Sep-04 to 19-Oct-06, when he was replaced by Mr Brandson Chong Cha Hwa (Mr Chong), who also became an INED of CRL a week later. Vital Pharma's auditors PwC resigned on 17-Dec-04, citing concerns about internal controls, an unsatisfactory response to a Stock Exchange inquiry, and an "unusual and disturbing" message from two Executive Directors which "contained certain emotional expressions".

IFMA

We pause to note that Mr Chong is also President of a HK company called International Institute of Business Administration Ltd, incorporated 31-Mar-03. It has a web site, the domain of which is registered to "Institute of Business Appraisers" and administered by BMI Technologies Ltd, owned by CBRT. Another interesting entity is International Financial Management Association Ltd, incorporated in HK on 29-Aug-05. It's "Standing director" is Roy Lo and its Vice President is Lowell Lo. The brothers Lo and Mr Chong are listed as trainers on its web site, www.ifmanet.org, which says it is a "global professional financial organization engaging in the research of theory and application of financial management".

However, there is another "International Financial Management Association", headquartered in Las Vegas, Nevada, with a different web site, www.ifmweb.org. That domain is registered to one Simon Tang of Houston, Texas. It is unclear whether the two organisations are associated, although they do apparently share several directors, including W J Fields Jr, whose shoe repair shop, at 3126 Las Vegas Boulevard North, doubles as the US headquarters. Zoom in to see it, between Sofia's Pizza and Elvia's Beauty Salon. So you can have lunch, get a facial, get your shoes repaired and join the IFMA all in one stop! Three of the directors of the US organisation, including Simon Tang, work for Certified Business Brokers, a firm in Houston. Another director, John Nechman, is an attorney at Simon Tang's law firm.

Another CBRT client was Zhejiang Yonglong Enterprises Co Ltd (Zhejiang Yonglong, 8211). Roy Lo was an INED of that from 14-May-02 to 26-Jun-02, before it listed on 8-Nov-02. He was replaced by T N Lui. The joint auditor at the IPO was KLL.

Incidentally, T N Lui has been an INED of CBRT since 30-Sep-04 (when the Listing Rules increased the requirement to 3 INEDs). So he serves on the board of CBRT as well as two of its former clients.

Barry Ip and Roy Lo are now Managing Director and Deputy Managing Director of ShineWing (HK) CPA Limited (ShineWing), an accounting firm which took over the practice of Ho and Ho & Company on 3-Aug-05. ShineWing is currently the auditor of 53 listed companies, including PME, CRL, China Fortune Group Ltd (China Fortune, 0290), Byford International Ltd (Byford, 8272), SIH, Zhejiang Yonglong and Vital Pharma, all of which have featured in our 3-part story so far, as well as ZZNode Technologies Co Ltd (ZZNode, 2371) which we will cover in a future instalment. Barry Ip changed from ED to NED of CBRT on 6-Aug-04 and on 1-Aug-05, he resigned effective 31-Oct-05, but continued to be employed as an external consultant and subsequently received more share options.

Tony Cheng has been an INED of North Mining Shares Co Ltd (0433) since 12-Apr-01. The shares of that company were suspended for 4 years from 6-Jun-03 to 2-Aug-07 after Chairman Qian Yong Wei, a Shanghai-based property developer, became uncontactable. It turned out that he was jailed for unrelated bribery offences. Roy Lo was appointed as INED on 25-Sep-04. Mr Qian is now out of jail, still the controlling shareholder, and his son Qian Yi Dong was appointed ED on 26-Mar-09. The re-election circulars for the AGMs held in 2004 and 2007 failed to disclose the HKIS disciplinary action against Tony Cheng.

Another pre-IPO client of CBRT, described but not named in the prospectus, was GP Nanotechnology Group Ltd (GPN, 8152, delisted) which was listed on 17-Jul-01, the day before CBRT itself. CBRT billed GPN $1.5m in the 2 years to 30-Apr-01. KLL was the joint reporting accountant, and the listing was sponsored by Shenyin Wanguo Capital (H.K.) Ltd. For more on the SFC's action against GPN (which followed a complaint from Webb-site.com) and the convicted criminal who the SFC alleges was behind GPN, see our side piece today.

Subsidiaries and investments

BM Innovation

On 8-May-02 CBRT agreed to place 32m shares (9.38% of enlarged) at $0.30 via Guotai Junan Securities (Hong Kong) Ltd raising $9.6m gross ($9.3m net).

In its listing prospectus, CBRT mentioned a private company then called Innovation (Asia) Ltd, "engaged in the provision of tutorial services for students" and owned as to 60% by Lowell Lo, 15% by his brother, 5% by his brother's wife and 20% by an independent third party. This was renamed BMI Innovation Ltd (Innovation) on 27-Feb-02, and some time in Jun-2002, CBRT subscribed for 30% of its enlarged capital for just HK$15,000, making it an associate and generating $351k of negative goodwill which CBRT booked as profit in the year to 30-Apr-03. By then it had dropped tutorials and was "engaged in the provision of event management services and corporate communications services". Within a month of the investment, on 9-Jul-02, CBRT announced that Innovation had applied for its own listing on GEM. Thankfully this is one deal which never saw the light of day.

During the six months to 31-Oct-05, CBRT sold its stake in Innovation to Roy Lo for $15,000, at cost.

BZR Capital

In Sep-03 CBRT acquired 60% of ZR Capital Ltd, a corporate finance advisor, for $300k and renamed it BZR Capital Ltd. On 26-May-09 it was renamed Chanceton Capital Partners Ltd. It has only done a handful of deals as financial adviser or independent financial adviser in the listed company arena.

BMI Wealth Management Ltd

During the year to 30-Apr-05, CBRT sold 28% of a subsidiary, then called BMI Wealth Management Ltd, to an independent third party for $27k, booking a gain of $3k, so it was pretty small at that stage. It got a bigger mention in the 2006 report, which said that it "specialises in providing wealth management services, provides an one stop comprehensive range of financial products and insurance linked product". In the year to 30-Apr-07, it got no mention at all, and was 93.28% owned at year-end, with its issued share capital expanded from $120k to $500k, implying that CBRT had invested another $300k. On 18-Jul-07 it was renamed Jumbo Alliance Funds Ltd (Jumbo Alliance). This was the only company which disappeared from the list of CBRT subsidiaries in the year to 30-Apr-08. According to note 35 of the accounts, one subsidiary was disposed of during the year for a cash consideration of $120k, so that was probably it. The business is alive and has a web site, which states that its director is Barry Ip. The Professional Insurance Brokers Association register states its Chief Executive as Terence Hui Chi Tat.

On 17-Dec-08, CBRT issued a clarification announcement regarding a press article which stated that BMI Funds and Jumbo Alliance are involved in litigation with a Mr Chan Wing Tat. CBRT then disclosed that Jumbo Alliance had been disposed of on 26-Jun-07.

Union Registrars

On 1-Apr-05 CBRT acquired a 4.9% interest in Union Services and Registrars Inc (BVI, Union Registrars) for HK$588k, and changed its registrars to Union Registrars Ltd on 15-Apr-05. On 9-Dec-05 CBRT bought another 2.1% interest in Union Registrars for $144k. On 8-Oct-07 CBRT bought another 8% of Union Registrars for $2m, taking its interest to 14.42%.

More events

On 19-Dec-05, CBRT appointed Mr Liu Ming Ming (M M Liu) as INED at the princely fee of HK$5k per year. He was also the general manager of two subsidiaries of CRL.

On 22-Feb-07, CBRT launched a placing of 74.2m new shares (16.59% of enlarged) at $0.218 (16.1% discount to market), raising $16.2m gross ($15.7m net), via Kingston Securities Ltd (Kingston Securities), "for general working capital".

On 1-Mar-07 M M Liu resigned for "personal reasons".

On 2-May-07, CBRT announced an MOU with Portstar Enterprises Ltd (BVI, Portstar) for a possible investment in Gold Regent Corp Ltd (HK, Gold Regent), which was engaged in PRC internet cafés. The owner of Portstar was not disclosed, but was an "independent third party". On 25-Jun-07, the MOU was replaced by an agreement for CBRT to buy 50% of Gold Regent from Portstar for a nominal price of $2. No funding plan had been determined for Gold Regent, which was still in negotiations to invest in an internet cafe operation. As we mentioned in Part 2 (China Railway Games) Portstar was also the entity which acquired the unsuccessful cargo leasing entity from CRL.

On 2-May-07 (the same day as CBRT's MOU with Portstar), Agnes Yeung Sau Han (Ms Yeung) was appointed as an executive director of PME. Then on 8-Jun-07, she was appointed as an ED of CBRT.

On 16-Jul-07, Yu Sau Lai (Ms Yu) was appointed as ED of CBRT. The annual report for the year ended 30-Apr-07 stated Ms Yeung and Ms Yu are "responsible for the business development of the Group, especially in the internet café business in the PRC" - in other words, the business which CBRT had acquired 50% of from Portstar. No further mention of the internet cafés was made after that.

Also on 16-Jul-07 CBRT appointed Yu Sau Lai (Ms Yu) as ED and Terence Chan Ho Wah (Terence Chan) and Cheever Cheung Siu Chung (Cheever Cheung) as INEDs. At the time Terence Chan was also an INED of CRL, and he was briefly an INED of SIH from 13-Nov-03 to 2-Jan-04. Ms Yeung, Ms Yu and Cheever Cheung may have known each other already - all were appointed as directors of Heng Xin China Holdings Ltd (HXC, then Tiger Tech Holdings Ltd, 8046) 5 days earlier on 11-Jul-07. That was the day on which HXC completed a placing of unlisted warrants to subscribe shares equivalent to 20% of its issued capital via Kingston Securities. The names of the placees were not disclosed. The warrants were all exercised on 16-Jul-07.

On 29-Aug-07 a 3 for 1 bonus issue by CBRT became effective.

On 6-Nov-07, CBRT launched a placing via Kingston Securities of 90m new shares (4.7% of enlarged) at $0.209 to raise $18.8m gross ($18.2m net). There was no plan for the cash, nor had they spent the $15.7m raised in the previous placing. Note that, because of the bonus issue, the effective issue price in the previous placing was now $0.0545.

PME takes over

On 21-May-08, CBRT agreed to sell BMI Funds Management Ltd and 45% of Fu Teng Ltd (BVI), which owned BMI Appraisals, to Lowell Lo, for a total of $63.4m in cash. At the same time, Lowell Lo sold his 27.1% stake in CBRT to PME for $99.9m, or $0.194 per share, and resigned from the board, along with CEO Mr Wong Wai Tung. CBRT shareholders approved the deal on 15-Aug-08, and both sales were completed on 29-Aug-08. The independent financial adviser on the connected transaction between CBRT and Lowell Lo was Guangdong Securities Ltd. The MD of that firm, Graham Lam Ka Wai, at the time was an INED of China Fortune and ZZNode and later of CRL.

On 23-Jun-08, Ms Yeung was appointed as CEO of CBRT, Oscar Wong Sai Hung (Mr Wong) was appointed non-executive Chairman for an annual fee which was mis-stated as $100k and later turned out to be $715k, while Joseph Orr Wai Shing (Mr Orr) and Raymond Lam Shiu Cheung (Raymond Lam) were appointed as INEDs. Mr Orr was already an INED of Byford since 7-Sep-07, while Raymond Lam became an INED of CRL (which was then 14% owned by PME) on 22-Dec-08. Mr Wong bought 30m shares (then 1.58%) of CBRT at $0.297 on 18-Jul-08.

CBRT gets a new skin

On 25-Jun-08, CBRT agreed to buy FD(H) Investments Ltd (BVI, FDH) from All Favour Holdings Ltd (BVI, All Favour), owned 50% by Lawrence Woo Hing Keung (Mr Woo), 45% by Ms Wan Fang Li, and 5% by Lin Hoi Kwong (Mr Lin), for $190m, of which $70m was in cash and $120m in 2-year 0% bonds which are convertible at $0.03 per share (a 90.3% discount to market) into 4,000m shares equivalent to 210.44% of the existing issued shares. Of the $70m in cash, $6m had already been paid as a deposit under an earlier letter of intent on 25-Feb-08. A further $14m was due by 30-Jul-08, and the rest on completion.

As you may recall from Part 1 (Byford story), Mr Woo has been an ED of Byford since 27-Oct-08. Mr Lin was an ED of China Fortune from 6-Dec-04 to 31-Oct-05 and an ED of China Sciences Conservational Power Ltd (CSCP, 0351) from 8-Feb-01 to 10-Feb-04. We'll cover CSCP in a future instalment. We know nothing about Ms Wan Fang Li. CBRT was advised by Nuada Ltd, and a circular was dated 29-Sep-08. The deal was completed on 29-Oct-08.

FDH in turn has acquired 51% of Shaanxi Aierfu Activtissue Engineering Co Ltd (Aierfu) which in turn owns 51% of three subsidiaries involved in the development of "tissue engineering products". Aierfu had one product named "Activskin", which was expected to be in mass production in 2009, and two others in clinical trials. It is unclear whether those are owned by Aierfu itself, or by its 51%-owned subsidiaries, namely Shaanxi Aierfu Bosheng Biological Engineering Co Ltd (Bosheng), Shaanxi Aimeiya Bio-Technology Co Ltd (Aimeiya) and Shaanxi Aierfu Cornea Engineering Co Ltd (Cornea).

Incidentally, the announcement of the letter of intent referred to Aierfu's product as "Apligraf" in the English translation. The announcement of the agreement referred to it as "Activskin". We only note this because Apligraf is a trademark of a similar product from Organogenesis Inc, which went into Chapter 11 in 2002 and re-emerged under private ownership in 2003. Other products in this space include: Dermagraft, originally produced by Advanced Tissue Sciences Inc, which went into Chapter 11 in 2002, and was taken over by Smith & Nephew and then sold to Advanced BioHealing Inc; and Orcel by Forticell Bioscience, Inc. As the bankruptcies indicate, firms have struggled to make money in this field. Dermagraft is currently listed at US$1,300 per piece, which hardly makes it a mass-market product, even in the USA.

The circular contained accountant's reports by Anthony Kam & Co., whose sole proprietor is Anthony Kam Hau Choi. According to the accountant's report, FDH acquired its stake in Aierfu on 19-Feb-08 for HK$50m in "other payables" or IOUs. The vendor was not named. Also on 19-Feb-08, Aierfu acquired 51% of Aimeiya and Cornea for RMB1.02m in cash and RMB13.20m in "other payables" respectively. The 51% stake in Bosheng had been acquired for RMB1m on 15-Nov-07. So on the face of it, All Favour was making a huge mark-up by charging CBRT $190m for something which had cost less than $70m to put together. Not only that, but as we mentioned, the consideration shares were being issued at a 90% discount to a market price - perhaps a tacit admission that the stock price was in a bubble, but nevertheless, those 4,000m shares were theoretically worth $1,240m at the market price of $0.31 before the announcement of the deal. Add that to the $70m of cash and you have a price of $1,310m, or a more than an 18-fold mark-up.

The circular also contained a valuation report by Grant Sherman Appraisal Ltd valuing Aierfu at HK$400m. This was the same firm which valued the assets at the core of the CRL railway wagon-leasing acquisition on 25-May-07.

Placing and ownership changes

On 14-Jul-08, CBRT entered into a placing agreement with Fortune (HK) Securities Ltd (Fortune Securities) to issue 380m shares (16.67% of enlarged) on a best-efforts basis. As we noted in Part 1, this broker is owned by China Fortune. This agreement was terminated on 15-Jul-08 and instead on 17-Jul-08 CBRT announced a placing of the same number of shares through CCB International Capital Ltd (CCBI) at $0.255 (17.7% discount to market) to raise $96.9m gross ($94.3m net). The placing was completed on 13-Aug-08. As you may recall from Part 2 (China Railway Games), CCBI was the broker in three CRL placings which raised $1,194m and one PME placing which raised $570m, in March to July 2007 on the back of railway-related deals which didn't work out.

On 15-Aug-08, two days later after completing the placing, CBRT amended the acquisition agreement with All Favour by agreeing that the $64m of remaining cash consideration (including the $14m which was due by 30-Jul-08) would now all be paid by 18-Aug-08 and forfeited if CBRT did not complete the acquisition. Perhaps All Favour needed the cash to settle the IOUs issued for FDH's purchase of its stake in Aierfu ($50m) and Aierfu's stake in Cornea (RMB13.2m=HKD14.52m) with had both been struck almost exactly 6 months earlier. However, that left CBRT's shareholders with a Hobson's choice at the EGM on 15-Oct-08 - either vote in favour, or wave goodbye to HK$70m. CBRT's acquisition of FDH completed on 29-Oct-08.

On 14-Nov-08, CBRT appointed Mr Tin Ka Pak as ED. He was already an ED of PME and ZZNode.

On 29-Sep-08, CBRT agreed to subscribe for HK$30m of convertible bonds issued by CSCP. At least two other listed companies in the same network as CBRT (HXC and later CRL) bought CSCP convertible notes too.

On 12-Mar-09, PME agreed to sell 500m shares (21.92%) of CBRT to Vital-Gain Global Ltd (BVI, VGG), an "independent third party", for $60m, or $0.12 per share. The Major Transaction was approved at an EGM on 3-Jun-09. According to disclosures of interests dated 4-Jun-09, VGG is 40% owned by one "Lu Na" and 40% by one "Wang Qing", but they quickly cut their stakes - see later.

On 24-Mar-09, CBRT appointed Mr Dai Yumin (Mr Dai) and Mr Luo Xian Ping as EDs. Mr Dai was then a "marketing consultant" of a subsidiary of PME. The announcement said that Mr Dai had agreed, for an unspecified price, to buy 60% of All Favour, which currently held the convertible bonds which CBRT had issued to buy FDH. It wasn't stated which of All Favour's 3 shareholders was selling.

According to disclosures of interests, on 5-Jun-09, one "Xu Jifeng" (via Honour Top Holdings Ltd) acquired 20% of All Favour, while Mr Dai (via Forerunner Technology Ltd) acquired 40% of All Favour, and the holding of Plenty Best Investments Ltd (which presumably was still owned by Wan Fang Li) was reduced from 45% to 40% of All Favour.

All hail the PLA

According to disclosures of interests, on 15-Jun-09, Sunbase Global Holdings Co. Ltd (BVI, Sunbase) acquired 60% of VGG for an undisclosed price. On the same day, Lu Na's and Wang Qing's stakes were each cut from 40% to 16% of VGG. We infer that they sold 48% to Sunbase, and the other 12% came from whoever owned the remaining 20%.

Sunbase is 50% owned by "Gunter Gao" and 50% by "Linda Yang". According to our records, Gunter Gao Jingde and Linda Yang are husband and wife. They also have a company called Sunbase International (Holdings) Ltd and a large property management firm called Sunbase International Properties Management Ltd which wins a lot of HK Government tenders. Gunter Gao is also a member of the CPPCC National Committee. You can read all about his patriotic works on this modest page of his firm's web site, not least:

"Dr. Gao generously supported the publication of The Great Rehearsal in the Taiwan Straits, The PLA Garrison Troops in Hong Kong, Scanning China's Peripheries, A Firm Rock in Midstream, and other valuable books with the intent of promoting the glorious image of the People's Liberation Army (PLA) as a civilizing and a powerful force and of spreading the superior tradition and revolutionary spirit of the PLA."

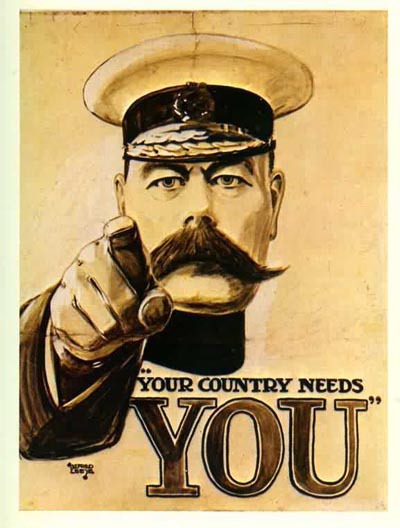

If that isn't enough to make you want to drop what you are doing and sign up to join the army, then what is?

Option grants

At each of the five AGMs of CBRT between 2002 and 2006, large chunks of options were approved for Lowell Lo and Barry Ip. Inbetween, as the share price fell, some of those options were cancelled to make room for new ones at lower exercise prices (there is a Listing Rules limit of 30% on outstanding options v share capital) and some were exercised, but by the end of the 2006 AGM, they each had options over shares equivalent to 9.43% of the existing issued share capital. After the 3:1 bonus issue (in effect a stock split), their options became 100m shares at $0.01 and 40m shares at $0.06125. They exercised 200m options at $0.01 on 17-Apr-09 (8.06% of the enlarged capital) and still hold the shares, which are suspended at $0.27.

Investment sales

Perhaps having a clear-out after its skin graft, on 31-Mar-09 CBRT agreed with Excalibur Securities Ltd (controlled by China Fortune) to place out various investments for HK$17m. These included shares in CRL and Byford and unlisted warrants in China Public Procurement Ltd (1094, then "Sunny Global Holdings Ltd"). We'll be covering that company in a future instalment of this series. On 29-Apr-09, CBRT agreed with Fortune Securities to place out for $34m the CSCP convertible bonds it had subscribed in Sep-2008. The buyers were not disclosed, and both asset sales were completed on 22-May-09. CBRT didn't say when it bought the shares, although balance sheets indicate that they were all purchased after 31-Oct-07.

Sale of the rest of BMI

On 8-Jun-09, Lowell Lo agreed to buy the remaining bits of BMI still owned by CBRT for HK$11.3m, subject to shareholders' approval. The stock is suspended pending a full announcement.

Valuation

Allowing for the 4,000m shares which could be issued on conversion of the bonds held by All Favour, and the outstanding 80m share options, CBRT has a potential issued capital of 6,560.88m shares. At the current market price, that's a market value of $1,771m. All that for a business, Aierfu, which has yet to generate sales, let alone profit. Don't put your skin in this game.

© Webb-site.com, 2009

Organisations in this story

- Anthony C.C. Kam & Co.

- ASIA ENERGY LOGISTICS GROUP LIMITED

- Beijing Energy International Holding Co., Ltd.

- BMI APPRAISALS LIMITED

- BMI FUNDS MANAGEMENT LIMITED

- BMI INNOVATION LIMITED

- CCB INTERNATIONAL CAPITAL LIMITED

- CGN Mining Company Limited

- Chanceton Capital Partners Limited

- Cherish Sunshine International Limited

- China Ever Grand Financial Leasing Group Co., Ltd.

- China Regenerative Medicine International Limited

- Chinese Food and Beverage Group Limited

- Chinese Strategic Holdings Limited

- Chuanglian Holdings Limited (KY)

- FORTUNE (HK) SECURITIES LIMITED

- GoFintech Quantum Innovation Limited

- GRANT SHERMAN APPRAISAL LIMITED

- Heng Xin China Holdings Limited

- INTERNATIONAL FINANCIAL MANAGEMENT ASSOCIATION LIMITED

- JUMBO ALLIANCE FUNDS LIMITED

- KINGSTON SECURITIES LIMITED

- KLL ASSOCIATES CPA LIMITED

- LO AND KWONG C.P.A. COMPANY LIMITED

- North Mining Shares Company Limited

- Nuada Limited

- PURVIEW (FAR EAST) LIMITED

- Shaanxi Aierfu Activtissue Engineering Co., Ltd.

- SHINEWING (HK) CPA Limited

- SINO CAPITAL SECURITIES LIMITED

- SUN HING VISION GROUP HOLDINGS LIMITED

- UNION REGISTRARS LIMITED

- Union Services and Registrars Inc.

- Zhejiang Yongan Rongtong Holdings Co., Ltd.

People in this story

- Chan, Terence Ho Wah

- Cheng, Tony Chak Ho

- Cheung, Cheever Siu Chung

- Cheung, For Sang

- Cheung, Sing Chi

- Chong, Brandson Cha Hwa

- Dai, Yumin

- Gao, Gunter Jingde

- Ip, Arnold Tin Chee

- Ip, Barry Yu Chak

- Lam, Raymond Shiu Cheung

- Lee, Daniel Ka Leung

- Lin, Aristo Hoi Kwong

- Lo, Lowell Wah Wai

- Lo, Roy Wa Kei

- Lui, Tin Nang (1957)

- Orr, Joseph Wai Shing

- Sun, Patrick Sai Man

- Tin, Timmy Ka Pak

- Wong, Oscar Sai Hung

- Woo, Lawrence Hing Keung

- Yang, Linda

- Yeung, Agnes Sau Han

- Yu, Sau Lai

Sign up for our free newsletter

Recommend Webb-site to a friend

Copyright & disclaimer, Privacy policy